– Solid Company-wide Execution Mitigated COVID-19 Impacts –

– Strong Double-Digit Y/Y Revenue Growth –

– Enhanced Liquidity Through Financing Activity and Cash Collections –

– Re-Affirms 2020 Guidance Range –

Second Quarter 2020 Financial Highlights:

- Revenues of $223.0 million

- Net Income of $4.4 million and GAAP EPS of $0.09

- Adjusted EBITDA of $24.1 million

- Non-GAAP EPS of $0.19

August 03, 2020 Eastern Daylight Time

FRAMINGHAM, Mass.–(BUSINESS WIRE)–Ameresco, Inc. (NYSE:AMRC), a leading energy efficiency and renewable energy company, today announced financial results for the fiscal quarter ended June 30, 2020. The Company has also furnished supplemental information in conjunction with this press release in a Current Report on Form 8-K. The supplemental information includes Non-GAAP financial metrics and has been posted to the “Investor Relations” section of the Company’s website at www.ameresco.com.

“Our exceptional second quarter results represented a continuation of our focus on the execution of our existing project backlog, more than offsetting any COVID-19 related incremental redeployment expenses and disruptions. Additionally, our performance reflected improved access to our project sites throughout the quarter, as more and more states loosened pandemic-related restrictions, and favorable weather conditions in many of our geographies supported seasonally stronger operating environments.

“We saw revenue growth across our projects, energy assets and O&M. Our long-term strategy to grow our renewable energy asset and O&M businesses, and the higher-margin recurring revenues they provide, give us the stability and visibility few companies have in this uncertain economic environment. During the quarter we also continued to experience strong demand for our design/build capabilities, executing on a number of large projects for a variety of government and commercial and industrial customers. Additionally, we were pleased to see progressive improvement in our business development activity throughout the quarter. We also improved our liquidity position during the quarter as a continued focus on cash collections and additional project and tax equity financing supported our asset buildout. We were pleased to see that the financing environment for low carbon solutions remains as robust as ever.

“During the quarter Ameresco received considerable industry recognition including a Top Project of the Year Award in the Environment + Energy Leader Awards program for our work at the United States Marine Corps Recruit Depot (MCRD) Parris Island. Also, our City of Phoenix RNG plant received honorable mention in Fast Company’s 2020 World Changing Ideas Awards. This RNG facility is the largest wastewater treatment biogas-to-RNG facility of its kind in the United States, illustrating again that Ameresco is the go-to company for the most complex advanced energy technology projects,” concluded George P. Sakellaris, President and Chief Executive Officer.

Second Quarter Financial Results

(All financial result comparisons made are against the prior year period unless otherwise noted.)

Revenues increased 13% to $223.0 million, compared to $198.2 million driven primarily by strong revenue growth across our three main businesses: projects, energy assets and O&M. While we continued to face a difficult environment due to COVID-19, Ameresco was able to execute on a greater-than-expected number of projects and saw minimal interruptions to its recurring revenue businesses. Gross margins of 17.7% were lower as a result of increased levels of design/build work along with other lower margin projects as part of the revenue mix, as well as unplanned maintenance and incremental COVID-19 related project costs. Operating expenses fell from $30.1 million to $26.6 million, and operating income was $12.9 million compared to $13.1 million as lower margin contribution from revenues offset the impact of controlled expenses and operating leverage from our design build revenue. Net income attributable to common shareholders was $4.4 million which reflects a non-cash downward adjustment of $4.5 million related to non-controlling interest activities. This adjustment was attributable to the timing of tax equity contributions on certain solar energy assets. Excluding this adjustment, Non-GAAP net income was $9.0 million compared to $8.6 million. Adjusted EBITDA, a Non-GAAP financial measure, was $24.1 million, compared to $23.6 million, an increase of 2%. EPS was $0.09 compared to $0.19, and Non-GAAP EPS was $0.19 compared to $0.18, an increase of 3%.

Project Backlog and Awards

Total project backlog at June 30, 2020 remained strong at $2.2 billion increasing 10% Y/Y and was comprised of:

- $1.0 billion in contracted backlog increased 29% Y/Y and represents signed customer contracts for installation or construction of projects, which we expect to convert into revenue over the next one to three years, on average; and

- $1.2 billion of awarded projects declined 3% Y/Y and represents projects in development for which we do not have signed contracts.

Second Quarter Project Highlights:

- A streetlight conversion pilot program on behalf of the Oregon Department of Transportation (ODOT), which will involve replacing more than 8,000 high-pressure sodium lighting fixtures with LEDs. The $18.6 million project is funded by an energy savings performance contract (ESPC) that will result in an estimated equivalent of 3,500 metric tons of carbon emissions saved annually.

- Second phase of work with the Worcester Housing Authority (WHA) totaling $13.5 million through its existing energy performance contract. This second-phase project extends the term of Ameresco’s work on behalf of WHA and builds on energy conservation measures the company implemented in 2008, bringing the total project value to $23.6 million affecting 15 of the WHA’s federal developments.

- An energy savings performance contract (ESPC) with the State of New Hampshire that will allow for energy conservation measures at over twenty state facilities throughout New Hampshire’s Seacoast Region.

- A contract from Duke Energy for the installation of $38 million of energy infrastructure measures under a Utility Energy Services Contract at the Marine Corps Air Station, Cherry Point. The project includes advanced technology features such as wastewater treatment optimization, cybersecurity network improvements, airfield lighting modernization, electrical distribution upgrades and AMI. Ameresco will also provide ongoing O&M commissioning services over the 20 year performance period.

- A prime contract on a large construction contract vehicle with a capacity of $975 million over five years with the Naval Facilities Command Mid-Atlantic (NAVFAC MIDLANT). Ameresco is one of 5 awardees selected to implement projects under this contract.

Ameresco Asset Metrics

Total operating assets were 264 MWe, assets in development increased to 313 MWe

- $938 million estimated contracted revenue and incentives during PPA period

- 14-year weighted average PPA remaining

Second Quarter Asset Highlights:

- 9 MWe placed into operations

- Gross 25 MWe added to the in-development pipeline

Contracted O&M Backlog

Total O&M backlog of $1.1 billion increased 25% Y/Y

- 16-year weighted average lifetime

Summary and Outlook

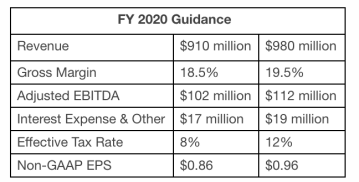

“First half results, along with visibility from our project backlog and recurring revenue streams, position Ameresco for year-on-year growth in 2020. We are pleased to reaffirm our full year guidance highlighted by revenues of $910 million to $980 million, Adjusted EBITDA of $102 million to $112 million, and Non-GAAP EPS of $0.86 to $0.96.”

“As the largest independent energy solutions company, and a leading provider of renewables, Ameresco is uniquely positioned to benefit from powerful secular trends. With an expanding addressable market, expertise in advanced technologies and our proven ability to finance projects and drive meaningful cost savings for our customers, we believe our services are more vital than ever in these challenging economic times,” Mr. Sakellaris concluded.

The Company’s guidance excludes the impact of any non-controlling interest activity and any additional charges relating to the Company’s restructuring activities, as well as any related tax impact.

Conference Call/Webcast Information

The Company will host a conference call today at 4:30 p.m. ET to discuss results. The conference call will be available via the following dial in numbers:

- U.S. Participants: Dial 1-877-359-9508 (Access Code: 4327839)

- International Participants: Dial 1-224-357-2393 (Access Code: 4327839)

Participants are advised to dial into the call at least ten minutes prior to register. A live, listen-only webcast of the conference call will also be available over the Internet. Individuals wishing to listen can access the call through the “Investor Relations” section of the Company’s website at www.ameresco.com. An archived webcast will be available on the Company’s website for one year.

Use of Non-GAAP Financial Measures

This press release and the accompanying tables include references to adjusted EBITDA, Non- GAAP EPS, Non-GAAP net income and adjusted cash from operations, which are Non-GAAP financial measures. For a description of these Non-GAAP financial measures, including the reasons management uses these measures, please see the section following the accompanying tables titled “Exhibit A: Non-GAAP Financial Measures”. For a reconciliation of these Non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see Other Non-GAAP Disclosures and Non-GAAP Financial Guidance in the accompanying tables.

About Ameresco, Inc.

Founded in 2000, Ameresco, Inc. (NYSE:AMRC) is a leading independent provider of comprehensive services, energy efficiency, infrastructure upgrades, asset sustainability and renewable energy solutions for businesses and organizations throughout North America and Europe. Ameresco’s sustainability services include upgrades to a facility’s energy infrastructure and the development, construction and operation of renewable energy plants. Ameresco has successfully completed energy saving, environmentally responsible projects with Federal, state and local governments, healthcare and educational institutions, housing authorities, and commercial and industrial customers. With its corporate headquarters in Framingham, MA, Ameresco has more than 1,100 employees providing local expertise in the United States, Canada, and the United Kingdom. For more information, visit www.ameresco.com.

Safe Harbor Statement

Any statements in this press release about future expectations, plans and prospects for Ameresco, Inc., including statements about market conditions, pipeline and backlog, as well as estimated future revenues and net income, and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including the timing of, and ability to, enter into contracts for awarded projects on the terms proposed; the timing of work we do on projects where we recognize revenue on a percentage of completion basis, including the ability to perform under recently signed contracts without unusual delay; demand for our energy efficiency and renewable energy solutions; our ability to arrange financing for our projects; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy; the ability of customers to cancel or defer contracts included in our backlog; the effects of our recent acquisitions and restructuring activities; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; availability and costs of labor and equipment; the addition of new customers or the loss of existing customers; market price of the Company’s stock prevailing from time to time; the nature of other investment opportunities presented to the Company from time to time; the Company’s cash flows from operations; and other factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the U.S. Securities and Exchange Commission on March 4, 2020, and in our Quarterly Report on Form 10-Q, filed with the U.S. Securities and Exchange Commission on May 5, 2020. Currently, one of the most significant factors, however, is the potential adverse effect of the current pandemic of the novel coronavirus, or COVID-19, on our financial condition, results of operations, cash flows and performance and the global economy and financial markets. The extent to which COVID-19 impacts us, suppliers, customers, employees and supply chains will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Moreover, you should interpret many of the risks identified in our Annual Report and Quarterly Report as being heightened as a result of the ongoing and numerous adverse impacts of COVID-19. In addition, the forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.